Your strategic partner awaits

Why you’ll love having a virtual CFO

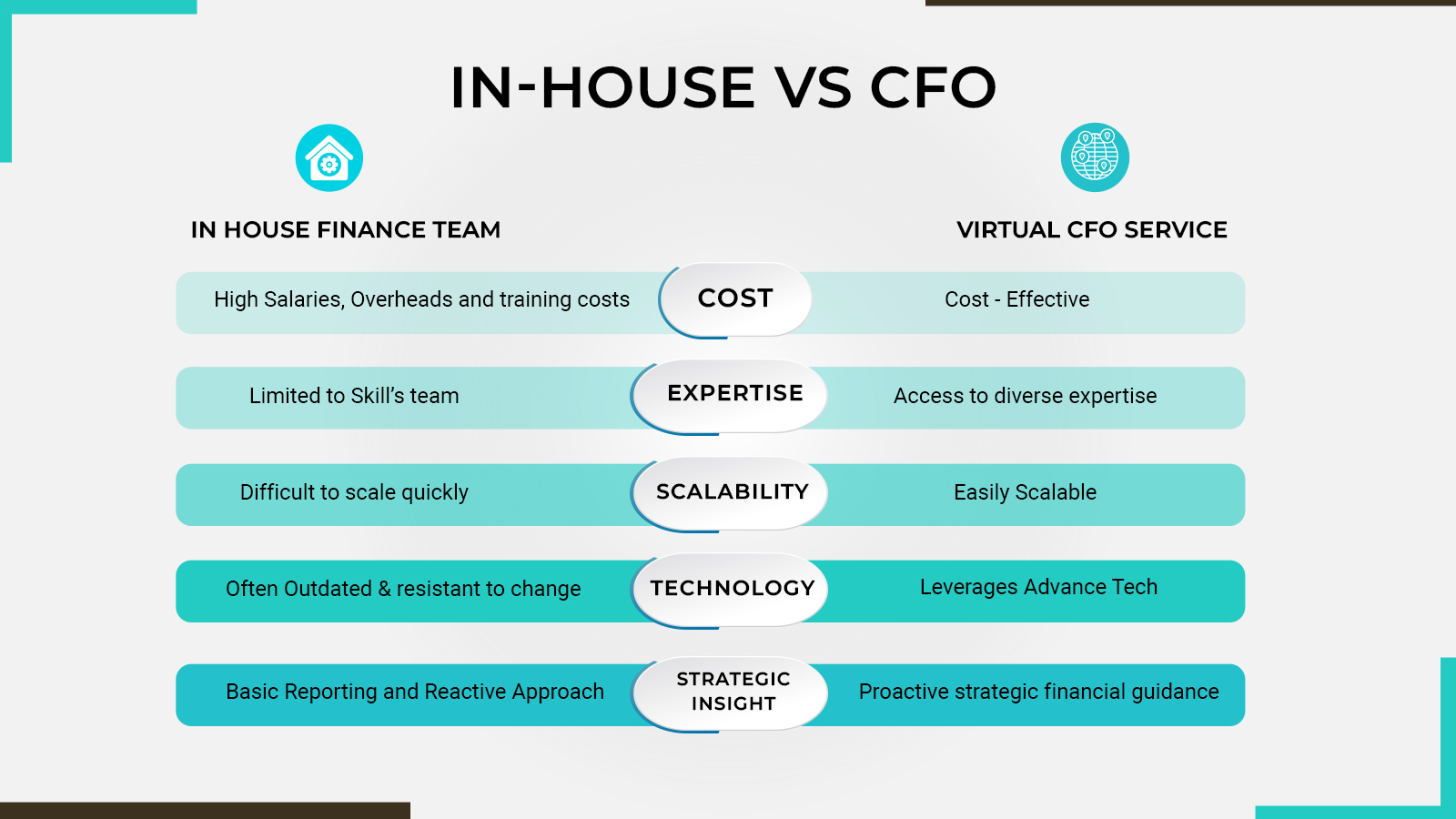

95% of companies aren’t large enough to afford, or even need, a full-time CFO. But establishing company-wide objectives — from policies and procedures to programs and practices aimed at continuous growth — is something that every business needs. That’s where our virtual CFOs come in.

Your virtual CFO will be dedicated to your team, there to support, nurture, and grow your big picture ideas into reality. Your business deserves a dedicated team member focused on key financial matters so that you can rest easy knowing you’re heading in the right direction.

WANT TO CHAT?

Let’s get started

Eager to boost your growth?

Call on our virtual CFOs..

Your hard work has paid off, and your business is thriving. But growth brings new challenges. Our virtual CFOs, armed with over 25 years of expertise, are here to help you navigate them with confidence.

Tailored Strategies: Every business is unique. That’s why our virtual CFOs take the time to understand yours. From launching a new product to navigating daily challenges, we utilize financial modeling to craft solutions that fit just right with your business and industry.

Stay Ahead: Growth means more numbers and decisions. Our CFOs use strategic planning to help you see beyond the figures and make moves that keep you a step ahead of competitors.

Plan for Tomorrow, Today: Financial surprises? Not on our watch. With sharp forecasting, equity capitalization, and advice on debt and capital raises, we pave the way for steady growth, ensuring your business thrives in the long run.

Board and Investor Relations: We help you foster connections with important stakeholders, providing board prep and reporting. Our focus is always on transparent communication and trust.

Always Here for You: Big decision or small, when you need a guiding hand or a second opinion, our virtual CFOs are just a call away, ensuring your journey is as smooth as possible.

Schedule a Free ConsultationFrequently Asked Questions

Often times businesses try to bring on a full-time CFO too quickly, and they end up functioning like a very expensive bookkeeper or controller. CFOs should handle essential operational tasks that ensure your company can continue to move forward.

We recommend bringing a fractional CFO on board when you start needing help with these tasks. A fractional CFO is a virtual CFO that you can pay on an as-needed basis, rather than hiring a full-time CFO.

A virtual CFO is a part-time or outsourced Chief Financial Officer who provides high-level financial expertise to a company without the cost of a full-time executive. They help businesses manage their finances, develop strategies, and make informed financial decisions.

A virtual CFO is beneficial for businesses that need expert financial guidance but do not require a full-time CFO. They can help with financial planning, cash flow management, budgeting, fundraising, and overall financial strategy, allowing you to focus on growing your business. Small to medium-sized businesses, startups, and growing companies often benefit from virtual CFO services.

A virtual CFO works on a part-time or project basis, providing the same level of expertise as a full-time CFO but at a fraction of the cost. This allows businesses to access top-tier financial talent without the overhead of a full-time executive.

A virtual CFO can provide a wide range of services, including financial planning and analysis, budgeting, cash flow management, fundraising, financial reporting, strategic planning, risk management, and more.

A virtual CFO typically collaborates with your existing finance team to enhance their capabilities and ensure alignment with your business goals. They provide leadership, mentorship, and strategic direction to help your team succeed.

Typically, the process begins with an initial consultation to understand your business needs. After this, a scope of work is defined, and an agreement is made on the engagement terms. The virtual CFO will then start working with your team to address your financial challenges and goals.